Being disabled can be difficult in any number of ways. This is true regardless of age – but it can be especially true as a disabled person grows older. The aging process can not only bring additional health concerns, but for disabled individuals, it may also bring financial concerns. Many who are receiving disability benefits wonder what might happen to their Social Security disability benefits after age 65 and when they reach retirement age – and that’s an understandable question to ask.

The good news is that typically, benefits in one form or another will continue to be provided to individuals who are either disabled or of full retirement age. A closer look at the types of benefits available and the conditions that apply can help provide peace of mind and plan financially for the future.

A Closer Look At Social Security Benefits

The Social Security Administration provides two types of benefits for disabled individuals, depending on their circumstances. These include:

- Social Security Disability Insurance (SSDI) Benefits: SSDI benefits are benefits that the Social Security Administration pays to individuals who have a qualifying medical condition that has rendered them disabled for a year or more and who worked a job through which they paid a portion of their salary into the Social Security system for a certain amount of time. Those individuals are considered “insured” in the eyes of the Social Security Administration and will receive benefits in an amount that is typically calculated based on their work and earnings history.

- Supplemental Security Income (SSI) Benefits: As with SSDI benefits, to be approved for SSI benefits, an individual must have a qualifying medical condition that renders them disabled for one continuous calendar year or more. Unlike the case with SSDI benefits, however, individuals who receive SSI benefits need not have worked a job through which they paid into the Social Security system. They do, however, have to have income and resources below a certain threshold established by the Social Security Administration.

It is important to understand that after age 65, standards for receiving disability benefits of both types will generally be less stringent than for those individuals of a younger age. This is because the Social Security Administration takes the aging process into account.

In addition to these two types of benefits, the Social Security Administration also offers:

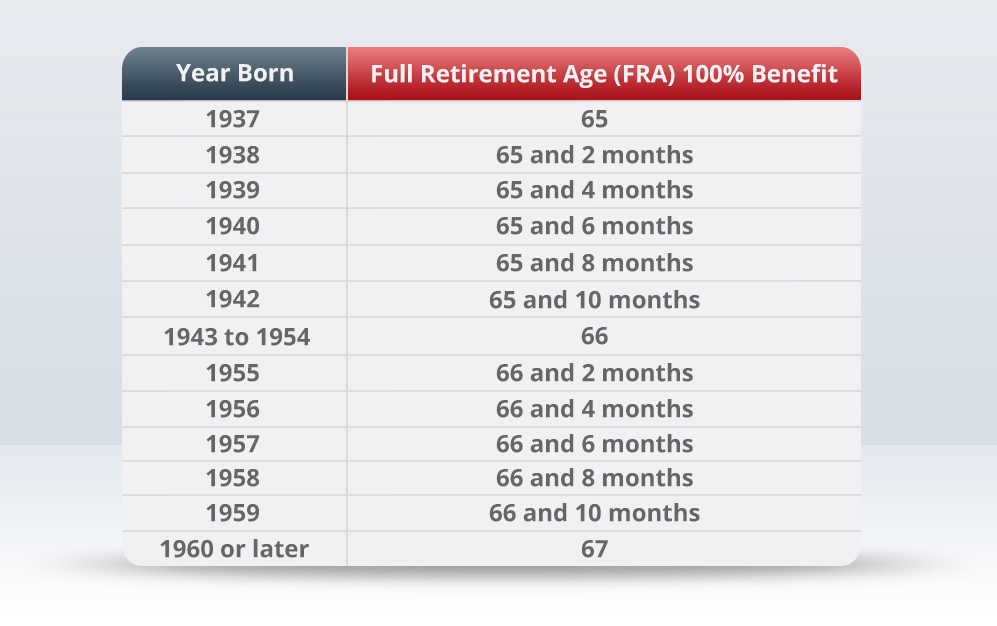

- Social Security Retirement Benefits: The Social Security Administration also provides retirement benefits to individuals who have reached full retirement age. Although many assume that the full retirement age is 65, this isn’t always the case. In fact, only those people born before 1937 have a full retirement age of 65. For individuals born after that date, the full retirement age will vary between age 66 and 67, depending upon the year the individual was born.

Understanding the types of benefits available and the conditions that apply to receive those benefits is essential. It’s also helpful to understand how receipt of one type of benefit may affect the other. Let’s take a closer look together.

Can Both Types Of Benefits Be Received At Once?

Generally, the law does not allow an individual to receive Social Security disability and retirement benefits simultaneously. As a result, when an individual receiving disability benefits reaches full retirement age, the disability benefits will essentially convert to retirement benefits.

The good news for those receiving benefits is that, ideally, this transition is easy and doesn’t involve an interruption of benefits. So, although benefits may technically be classified as retirement instead of disability, the recipient typically continues to receive their monthly checks on roughly the same schedule.

It’s also important to keep in mind that when a disabled individual reaches full retirement age, there aren’t any necessary steps to take to convert the benefits being received from one type to the other. Generally, the conversion of benefits will happen automatically, without any action on the part of the recipient.

Another essential thing to remember is that those individuals who reach full retirement age are no longer subject to the same income limits set by the Social Security Administration that typically apply to the receipt of disability benefits. As a result, individuals may earn additional income and still receive benefits if they choose to do so.

Sackett Law – Your Disability Benefits Attorneys

At Sackett Law, our talented and experienced attorneys understand every aspect of the law pertaining to Social Security disability benefits, and we know the best legal strategies to pursue on your behalf. We will always fight for you to receive the maximum amount of compensation you deserve, and we’ll keep you informed and involved in your claim every step of the way. If you need assistance with any aspect of the process of pursuing disability benefits, we’re here for you. Give us a call today. We look forward to speaking with you soon.

2 Replies to “What Happens to Social Security Disability Benefits After Age 65?”

Thank you for your explanation when you told us that Social Security disability insurance benefits refer to the benefits paid by the Social Security Administration to individuals with the qualifications that render them disabled for a year or more and who have worked a job where a portion of their salary is paid into the SSS for a certain amount of time. My aunt used to be a private company accountant but she cannot work at the moment because of a terrible accident that affected a part of her vision and her legs. I’ll take note of this while I help her find a social security disability lawyer in Sacramento to assist her with her benefits soon. https://www.milamlaw.com/social-security-disability

corrupti dolorem quam eveniet consequatur sunt est totam odit quibusdam. culpa et voluptas delectus dolores ut sequi aut.