When your ability to earn a living is limited by a disability that is expected to last for a year or longer, it can be difficult to pay the bills and stay financially afloat. The Social Security Administration can help with the Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) disability programs.

The monthly cash payment through SSI and SSDI certainly helps relieve financial pressures, but you need to know how to qualify for disability in California because it is not an easy process. An average of only 31% of applications for disability benefits are approved. Two ways to improve your chances of being approved are to continue reading to learn how to qualify for disability and get help with the application process from a disability lawyer with more than 40 years of experience at Sackett and Associates.

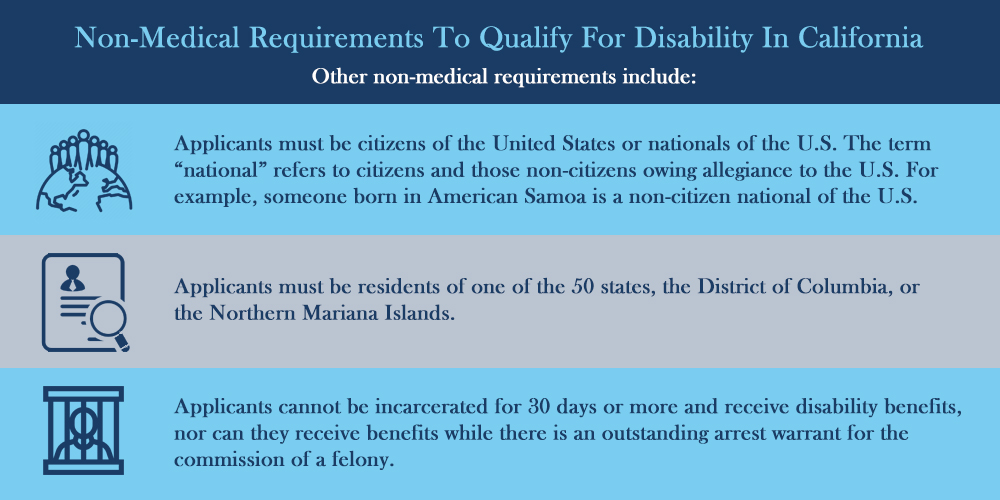

Non-Medical Requirements To Qualify For Disability In California

The process to determine whether you qualify for disability in California starts when you apply for benefits. The first stage in the determination process is for the Social Security Administration to review the application. This initial review focuses on non-medical eligibility requirements.

SSI is a need-based program, so the non-medical eligibility requirements focus on your income and assets. Essentially, you cannot have more than a limited amount of income, and the value of the assets or resources that you own cannot exceed $2,000 as an individual or $3,000 for couples.

Other non-medical requirements include:

- Applicants must be citizens of the United States or nationals of the U.S. The term “national” refers to citizens and those non-citizens owing allegiance to the U.S. For example, someone born in American Samoa is a non-citizen national of the U.S.

- Applicants must be residents of one of the 50 states, the District of Columbia, or the Northern Mariana Islands.

- Applicants cannot be incarcerated for 30 days or more and receive disability benefits, nor can they receive benefits while there is an outstanding arrest warrant for the commission of a felony.

If you are unsure about meeting the non-medical eligibility requirements, ask a disability lawyer at Sackett Law to review your claim to ensure that you meet them.

SSDI has eligibility requirements that focus on your work history. You must have a work record showing that you worked long enough and recently enough at jobs or self-employment where you contributed to the Social Security system through the taxes paid on the income that you earned.

Social Security uses work credits to determine eligibility for SSDI. You earn up to four credits a year with one credit earned in 2023 for each $1,640 in wages or income from self-employment. Workers typically need 40 work credits with 20 of them earned within 10 years prior to the onset of their disability. Check with a disability lawyer because your age may affect the number of work credits needed to qualify for disability in California with younger workers needing fewer credits.

Meeting The Medical Requirement To Qualify For Disability In California

If you meet the non-medical requirements to qualify for disability benefits through SSI or SSDI, Social Security sends your application to Disability Determination Services. A DDS examiner reviews the application to decide whether you are disabled as defined by federal regulations. The examiner may request additional information from you or from your doctors, including additional medical records.

An examiner may determine an additional medical examination is needed. A consultative exam may be scheduled using the physician or other health care professional treating the applicant. Still, there may be circumstances that result in the examination being scheduled with someone other than a treating medical provider.

The purpose of evaluating the medical evidence supporting the claim is to determine whether you are disabled. Federal regulations define a disability as an inability to do any substantial gainful activity because of a medically determinable mental or physical impairment or combination of impairments expected to last for at least one year or can be expected to result in the death of the claimant.

“Substantial gainful activity” refers to work activities. A substantial work activity requires significant mental or physical activity to perform. Walking, climbing stairs, and lifting heavy objects are examples of substantial physical activities. An example of a substantial mental activity would be the ability to remember and apply instructions that you were given to accomplish a task.

Gainful activity refers to the fact that it is done or usually done for pay. If you work and earn more than $1,470 a month in 2023, you are considered to be engaging in substantial gainful activity. A person with a disability based on being statutorily blind earning more than $2,460 a month is engaging in substantial gainful activity.

Get Help From A Disability Lawyer

Social Security rules and regulations to qualify for disability in California are complex. Improve your chances by having a Sackett and Associates disability lawyer handle your application for benefits or appeal a denial of benefits. Learn more about how we can help by contacting us for a free consultation.

2 Replies to “How To Qualify for Disability Benefits In California”

I want help applying for disability benefits

Husband was payee for disabled biological child as well as disabled step child he raised but didn’t adopt. He passed away 12/31/23 and I his wife would like the information on how to file for death benefits for both sons.