What is the amount that you will receive as your Social Security Disability (SSD or SSDI) benefit payment? This may be the most important question in your mind when applying for SSD benefits.

As a matter of principle, the SSD monthly benefit amount is determined on the basis of the number of years for which you worked before applying for the SSD claim and your average earnings over those years.

The Basis For Determining SSD Benefits

The Social Security Disability Insurance (SSDI) program was created with the objective of supporting workers and former workers who suffered a disabling injury or illness that renders them unable to work enough to earn a living. Workers are required to pay money into the Social Security Trust Fund when they are working, and benefits are paid from this Fund.

SSD benefits are therefore limited to those who have worked long enough and recently enough to earn the required number of “worked credits” for receiving them. As of 2022, a worker earns one work credit for earning every $1,510 in income. The number of work credits required to qualify for receiving SSD benefits depends on the age at which the claimant became disabled.

Generally, 40 work credits are required to qualify for SSD benefits but a person becoming disabled at a young age won’t have worked for the required years to earn 40 credits. Instead, a worker between the age of 24 and 31 years must have worked at least half of the years since they were 21.

Therefore, if a worker gets disabled at age 29, then he needs to have worked for at least 4 years (half the years since they were 21), which would mean earning at least 16 work credits.

Calculation of SSD benefits based on Average (Indexed) Monthly Earnings? (AIME)

The purpose of SSD benefits is a partial replacement of the income that the claimant would have earned, but for the disability. For this purpose, the Social Security Administration (SSA) looks at the 35 highest income earning years during the claimant’s working life. Only that income that is reported to the IRS is used for determining the benefit amount. On the other hand, income that is unreported or tax-exempt is not counted for the purpose of determining a claimant’s Social Security Disability benefit amount.

For determining your SSD benefit amount, indexing is followed. The highest 35 yearly incomes are indexed by the SSA, and each year’s income is adjusted to reflect the national average annual income for that year. This ensures that the increased cost of living over those 35 years is taken into consideration. The amount of money earned in 1985 wouldn’t have the same value in 2015.

Further, the 35 highest yearly indexed annual incomes are added together and divided by 35 and 12 consecutively. This leads the SSA to your Average Indexed Monthly Income (AIME) which is later used to calculate the SSD benefit amount.

The SSA plugs the AIME into a formula to determine a claimant’s SSD benefit amount. Since the AIME of every claimant is unique, the formula always produces a different result and a different SSD benefit amount.

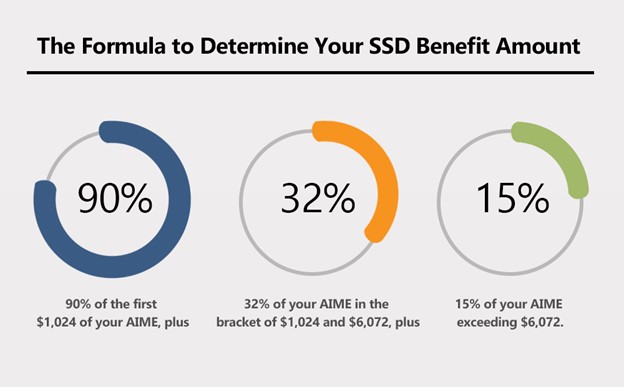

The Formula To Determine Your SSD Benefit Amount

Once your AIME is determined, arriving at your SSD benefit follows compliance with a short, fixed formula. Your Primary Insurance Amount (PIA) is calculated by following the given formula-

Rounding off the PIA

Your PIA is equivalent to your SSD benefit amount for all practical purposes. But like all intricate calculations, your PIA too could end up being a figure in decimals. Now, the last step is to round off the PIA amount to the next lowest whole Dollar. This figure is your SSD benefit amount.

For example, if the Primary Insurance Amount of one Mr. X comes out to be $2,679.70, then the SSA will round it off to the next lowest whole Dollar, that is, $2,679. This will be Mr. X’s monthly SSD benefit amount.

Contact Sackett and Associates For Assistance From An Experienced SSD Lawyer

Sackett and Associates have vast experience representing Social Security Disability claimants and are committed to helping you with your claim.

Our entire team of disability law attorneys and trained SSDI advocates is dedicated to ensuring that you get the highest possible SSD monthly benefit amount.

We are more than just a law firm and we understand your situation. We advise you to not settle for anything less than the best possible representation when it comes to your monthly SSD benefits claim. Contact us to take on the SSA for your SSD benefits.

Leave A Comment