When you consider if you can collect Social Security at 66 and still work full-time without losing out on your benefits, you need to remember that after reaching the full retirement age (FRA) you can earn an unlimited amount of income and yet receive full retirement benefits.

Retirement benefits are not really concerned with whether you have a source of income while collecting the benefits, rather they are only concerned with whether you started collecting benefits at your full retirement age or started collecting them before reaching your FRA. However, there is no uniform full retirement age, and it differs according to the year of a person’s birth. Whether you can retire at 66 and still work full time depends entirely on whether your full retirement age is 66.

However, if you collect Social Security retirement benefits before reaching your FRA, you will face a reduction in the amount of your benefits depending on the income that you continue to earn.

Find your Full Retirement Age (FRA)

Until 1983, every American had the same retirement age- 65 years. However, it was believed that the Social Security System would run into insolvency if the FRA were kept at 65 and not raised for the purpose of receiving Social Security retirement benefits.

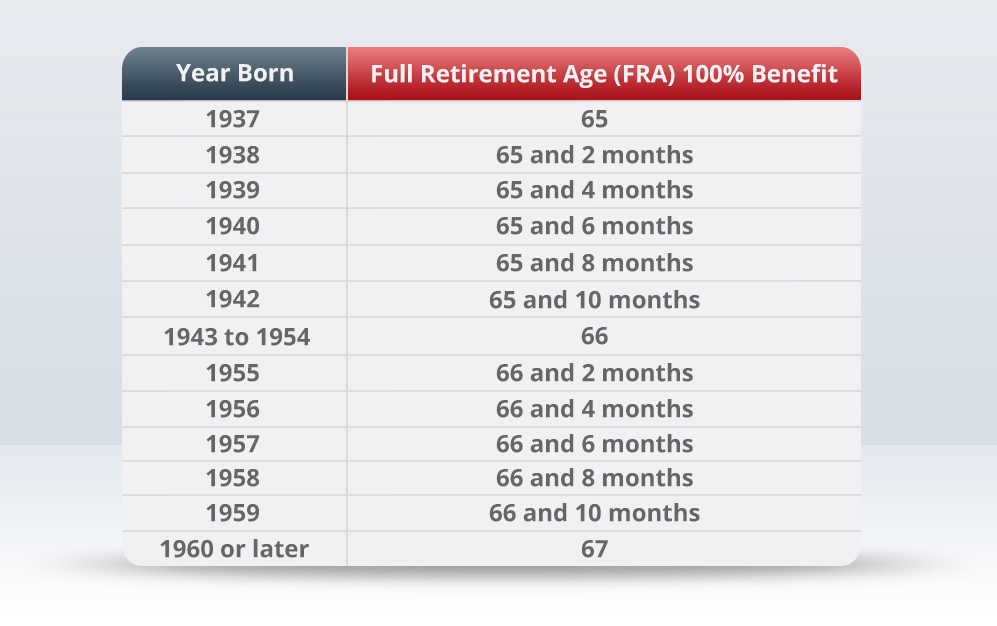

After 1983, the law provided for a gradual rise in the age at which future retirees could claim Social Security benefits. Instead of everyone qualifying for full Social Security retirement benefits at age 65, there was an increase of 2 months for each successive year in which a person was born.

However, a uniform FRA was set for those born between 1943 and 1954. Every American born in these years is eligible for full retirement at age 66. Between 1955 and 1960, the FRA increases by 2 months for every successive year. Therefore, an American born in 1960 is eligible for full retirement at the age of 67 years.

You can check your full retirement age by checking the FRA chart on the website of the Social Security Administration (SSA). You can start collecting Social Security retirement benefits by the time you turn 62 years old and as late as age 70, regardless of what your full retirement age is.

Claiming Social Security Retirement Before Full Retirement Age

The law permits you to claim Social Security retirement benefits before reaching the full retirement age. However, by doing so, you will have to forfeit a major portion of the benefit amount that you would have received had you retired at your full retirement age to claim benefits.

Only if you claim Social Security retirement benefits before reaching the full retirement age, you will have to suffer a limitation as to what you may earn in other income without getting your retirement benefits reduced.

To learn how to calculate the amount of Social Security retirement benefits, one has to follow a standard of retirement benefits at different ages. Therefore, a person collecting Social Security retirement benefits at the age of 62 would be able to claim 44% lesser benefits than a person retiring at the age of 70 years. This is only natural because every individual is expected to keep earning and not retire before their full retirement age. If the SSA needs to suddenly pay retirement benefits way before schedule, it can balance out the disruption only by reducing the monthly retirement benefit.

As for the income limit beyond which one must face a cut in Social Security retirement benefits, it has been set at $19,560 for the year 2022. For every two dollars earned beyond this threshold, one dollar of the monthly benefit payment will be docked. So, if a person earns $26,560 in 2022, the income will exceed the upper cap by $7,000 and the Social Security retirement benefit will be reduced by $3,500, that is, an amount equal to half of the excess income.

Can you work full time at 66 and avoid losing out on Social Security retirement benefits?

If your full retirement age as per your birth year is 66, you don’t have to worry about the income that you make from full-time work. Social Security allows you to make unlimited income while you also collect Social Security retirement benefits.

If your full retirement age is beyond 66 and you still decide to retire at 66, you do face a cut in your retirement benefits in case you exceed the threshold income limit. It is therefore always a good idea to wait until your full retirement age before you start collecting Social Security retirement benefits. The reason is simple- your monthly benefit payments will be higher than that you could collect before your full retirement age.

Leave A Comment