For millions of people across the country, Social Security benefits of one kind or another are an essential source of financial support. This is especially true with advancing age – and particularly if you have a disability. Advancing age can bring many challenges, and as we age, many of us want to know that we will be safe and secure, from a financial perspective. As a result, many often wonder how Social Security benefits might change with age and how to apply for those benefits. These are reasonable and understandable questions to ask.

Depending upon a particular individual’s circumstances, there are various types of Social Security benefits available. The two general categories of Social Security benefits are retirement benefits (both for early and full retirement) and disability benefits (SSDI and SSI benefits). Let’s take a closer look at each, how much you might receive at or around age 62, and how to apply.

What Types Of Benefits Are Available?

As we’ve noted, the Social Security Administration generally provides two types of benefits: retirement benefits and disability benefits.

Social Security Retirement Benefits:

As many people know, Social Security retirement benefits are those benefits that are paid to individuals who have reached retirement age and who have paid into the Social Security system throughout their employment history (or who qualify for credits based upon their spouse’s earning history). The benefits paid are typically based on the salary from which the individual paid into the Social Security system. Accordingly, the higher the salary, the higher the benefit amount, up to a specific legally established limit.

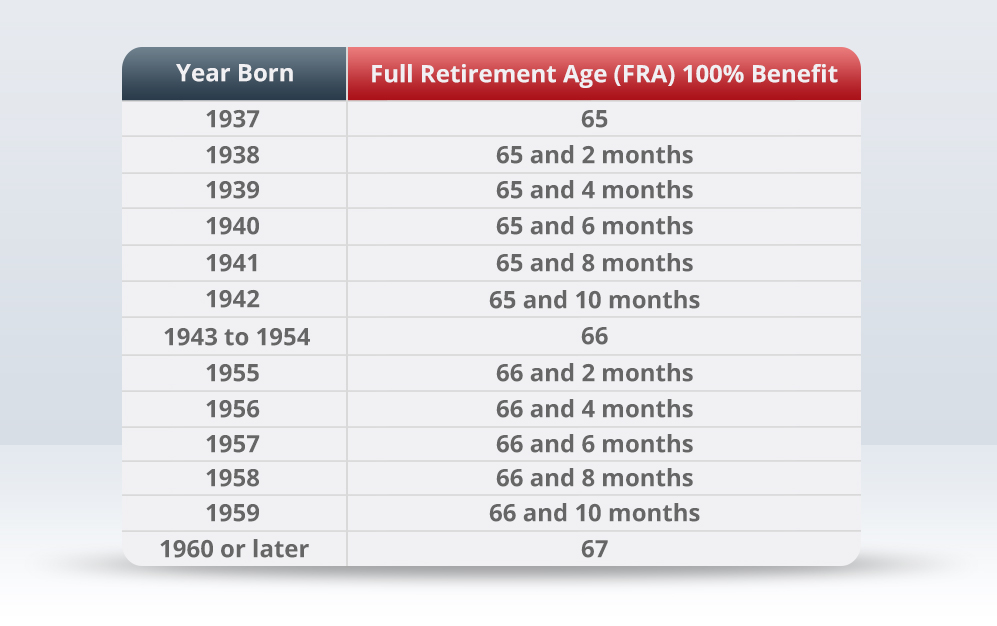

As a general rule, an individual will qualify for the “maximum benefit amount” when they reach “full retirement age.” What is considered “full retirement age” will vary based on the birth year of the person seeking benefits. For those born in 1956 or earlier, for example, the full retirement age is considered to be 66 and 4 months, and gradually rises to 67 for those born in 1960 or later. Those who choose to retire early – for some people as early as age 62 – can receive benefits, but the amount of those benefits may be diminished by as much as 30%.

Ultimately, the best way to know one’s potential retirement amount is to complete the application and receive confirmation on the actual amount from Social Security. Those who wish to apply for retirement benefits can begin the process:

- Online

- By calling (800)772-1213 or visiting your local Social Security office

- By contacting an attorney who can guide you through the process

Typically, Social Security retirement benefits are paid from the date of eligibility through death.

Social Security Disability Benefits:

The Social Security Administration is responsible for paying two types of disability benefits – Social Security Disability Insurance (SSDI) benefits and Supplemental Security Income (SSI) benefits. Both programs require that the applicant have a qualifying medical disability that has rendered them unable to work for one calendar year or more. To receive SSDI benefits, an applicant must be “insured,” – meaning that they worked a job for a sufficient length of time through which they paid money from their salary into the Social Security system. SSI benefits do not require that an individual be insured, but they do require that the applicant have income and resources below a certain level established by the Social Security Administration.

The amount of SSDI benefits an individual might receive will not be dependent upon their particular medical condition, but rather, on their earning history. The amount of SSI benefits also does not depend upon the condition itself, but is typically based on the resources of the particular individual in question.

Those who receive SSDI benefits should know that typically, the benefit will convert to a retirement benefit once the individual reaches retirement age because both types of benefits cannot be collected simultaneously. This transition will usually occur automatically. Unlike SSDI payments, SSI payments will not convert to retirement benefits when a person reaches “early retirement age” at 62 if the individual would not normally qualify for those benefits.

Understandably, issues surrounding disability benefits can be complex – whether you are age 62, or any other age. Applying for those benefits can be a complicated process, depending on your circumstances. As a result, finding an attorney who can guide you through the process with the knowledge and experience you need on your side will be essential. At Sackett Law, we’re here for you.

Call Sackett Law Today

Social Security benefits are an essential source of financial stability for many people. At Sackett Law, we understand that. We also understand that the process of seeking benefits can seem complex and overwhelming at first. That’s why we’re here to help. We’ll walk with you each step of the way as you pursue the benefits you need and deserve. We understand every aspect of the process of seeking benefits, and we know the best legal strategies to pursue on your behalf. If you’re ready to get started, give us a call. We look forward to helping you soon.

Leave A Comment